The latest version of Open Tax Solver, 23.03, has been released, offering users an efficient and user-friendly tool for managing their tax returns. This program allows individuals to calculate entries for various Tax Return Forms and ascertain their tax liabilities or potential refunds for both Federal and State personal income taxes.

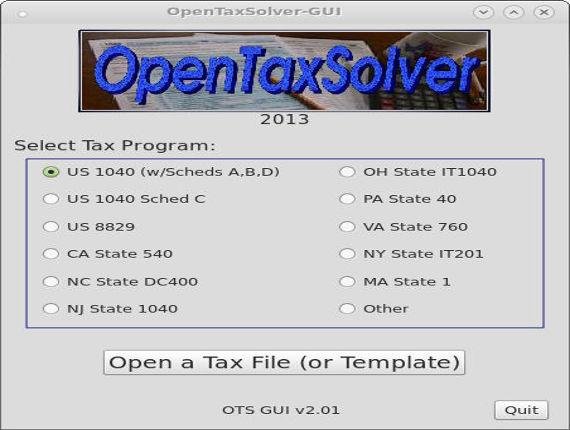

Open Tax Solver supports updated versions of key documents, including the US 1040 form and its associated schedules (A, B, C, D), along with multiple state-specific forms. One of the standout features of OTS is its dual interface options: users can choose between a graphical interface or a more traditional textual one, catering to different preferences and enhancing usability.

Key Features of Open Tax Solver:

- Graphical and Textual Interfaces: Offers flexibility in how users interact with the software.

- Efficiency: Designed for straightforward and quick completion of tax returns.

- Safety and Security: Operates directly on the user's personal computer, eliminating concerns over web-based vulnerabilities or hidden software.

- Direct Form Filling: Simplifies the process of completing tax forms for easy printing.

In addition to these features, Open Tax Solver continually updates its offerings to ensure compliance with the latest tax regulations and requirements. Future updates may include more state forms, enhanced user interfaces, and additional tools for tax planning and management, further streamlining the tax preparation process for users. As tax laws evolve, staying updated with software like Open Tax Solver is essential for accurate and efficient tax filing

Open Tax Solver supports updated versions of key documents, including the US 1040 form and its associated schedules (A, B, C, D), along with multiple state-specific forms. One of the standout features of OTS is its dual interface options: users can choose between a graphical interface or a more traditional textual one, catering to different preferences and enhancing usability.

Key Features of Open Tax Solver:

- Graphical and Textual Interfaces: Offers flexibility in how users interact with the software.

- Efficiency: Designed for straightforward and quick completion of tax returns.

- Safety and Security: Operates directly on the user's personal computer, eliminating concerns over web-based vulnerabilities or hidden software.

- Direct Form Filling: Simplifies the process of completing tax forms for easy printing.

In addition to these features, Open Tax Solver continually updates its offerings to ensure compliance with the latest tax regulations and requirements. Future updates may include more state forms, enhanced user interfaces, and additional tools for tax planning and management, further streamlining the tax preparation process for users. As tax laws evolve, staying updated with software like Open Tax Solver is essential for accurate and efficient tax filing

Open Tax Solver 23.03 released

Open Tax Solver is a safe, secure, easy-to-use program for calculating Tax Return Form entries and determining your tax-owed or refund-due for Federal or State personal income taxes.