HomeBank has recently released version 5.9.1, which is a free and user-friendly software designed to help users manage and analyze their personal finances with detailed insights. It offers powerful filtering tools and graphical representations of financial data, making it an ideal choice for those seeking a comprehensive accounting solution. Additionally, a Portable version is available for those who prefer a more flexible option.

HomeBank allows users to import and export data from various formats, including QIF, OFX, QFX, and CSV. This feature is particularly beneficial for users transitioning from other financial management programs like Quicken or Microsoft Money. The software includes a duplicate detection feature that helps identify and manage duplicate transactions effectively. Users can also export their financial data in QIF format and various data segments to CSV.

One of the standout features of HomeBank is its dynamic reporting capabilities. Users can generate various reports that present financial information through visually appealing 2D charts. The reporting system allows for easy adjustments to parameters and provides options for filtering transactions by different fields. Users can also track their budgets, monitor account balances, and analyze vehicle costs and fuel consumption.

HomeBank’s budgeting tools enable users to set monthly or annual budgets for different categories, with the option to view non-budgeted categories in reports. Users can import and export budget data in CSV format and take advantage of beautiful chart designs inspired by Google Analytics.

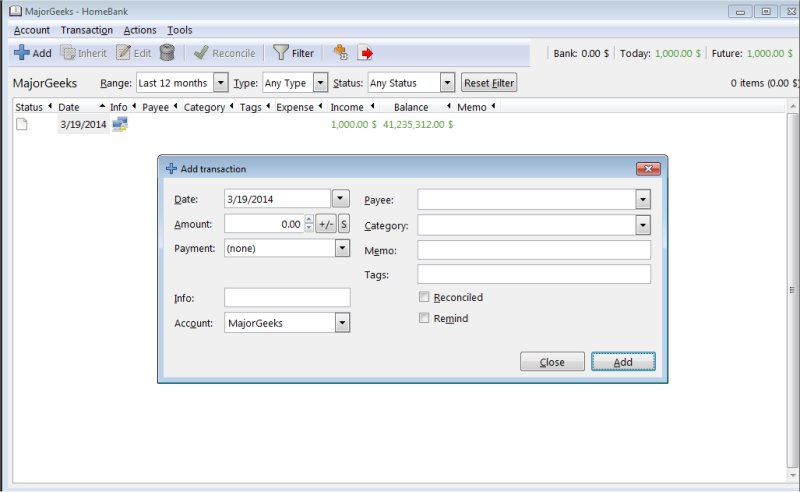

The software also provides robust transaction management features. Users can schedule recurring transactions, split amounts across multiple categories, and automate internal transfers between accounts. An intuitive interface allows for quick creation of transaction templates, as well as the ability to edit multiple transactions simultaneously. Users can categorize and tag transactions for enhanced analysis and set reminders for outstanding debts.

Finally, HomeBank facilitates automatic assignment of categories and payees based on predefined rules, and it allows for the direct addition of new categories and payees from the transaction register. The auto-completion feature helps users efficiently navigate through extensive lists of categories and payees.

In summary, HomeBank 5.9.1 is an excellent tool for managing personal finances, offering a wide range of features for budgeting, reporting, and transaction management. Its focus on user-friendliness, combined with powerful analytical tools, makes it a standout choice for anyone looking to take control of their financial situation. Future updates could potentially include integrations with online banking services and improved mobile access to enhance user experience even further

HomeBank allows users to import and export data from various formats, including QIF, OFX, QFX, and CSV. This feature is particularly beneficial for users transitioning from other financial management programs like Quicken or Microsoft Money. The software includes a duplicate detection feature that helps identify and manage duplicate transactions effectively. Users can also export their financial data in QIF format and various data segments to CSV.

One of the standout features of HomeBank is its dynamic reporting capabilities. Users can generate various reports that present financial information through visually appealing 2D charts. The reporting system allows for easy adjustments to parameters and provides options for filtering transactions by different fields. Users can also track their budgets, monitor account balances, and analyze vehicle costs and fuel consumption.

HomeBank’s budgeting tools enable users to set monthly or annual budgets for different categories, with the option to view non-budgeted categories in reports. Users can import and export budget data in CSV format and take advantage of beautiful chart designs inspired by Google Analytics.

The software also provides robust transaction management features. Users can schedule recurring transactions, split amounts across multiple categories, and automate internal transfers between accounts. An intuitive interface allows for quick creation of transaction templates, as well as the ability to edit multiple transactions simultaneously. Users can categorize and tag transactions for enhanced analysis and set reminders for outstanding debts.

Finally, HomeBank facilitates automatic assignment of categories and payees based on predefined rules, and it allows for the direct addition of new categories and payees from the transaction register. The auto-completion feature helps users efficiently navigate through extensive lists of categories and payees.

In summary, HomeBank 5.9.1 is an excellent tool for managing personal finances, offering a wide range of features for budgeting, reporting, and transaction management. Its focus on user-friendliness, combined with powerful analytical tools, makes it a standout choice for anyone looking to take control of their financial situation. Future updates could potentially include integrations with online banking services and improved mobile access to enhance user experience even further

HomeBank 5.9.1 released

HomeBank is an easy way to analyze and keep track of all your personal finances in detail using powerful filtering tools and graphs for free. A Portable version is also available.